In a recent analysis, JPMorgan Chase has expressed skepticism regarding the prospect of a trillion-dollar stablecoin market by 2028. While the stablecoin sector has seen significant growth in recent years, various factors contribute to JPMorgan’s cautious outlook.

Understanding Stablecoins

Before delving into JPMorgan’s analysis, it’s essential to understand what stablecoins are. Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve asset, typically fiat currencies like the US dollar or commodities such as gold. This stability makes them appealing for transactions and as a store of value in the volatile cryptocurrency market.

The Current State of the Stablecoin Market

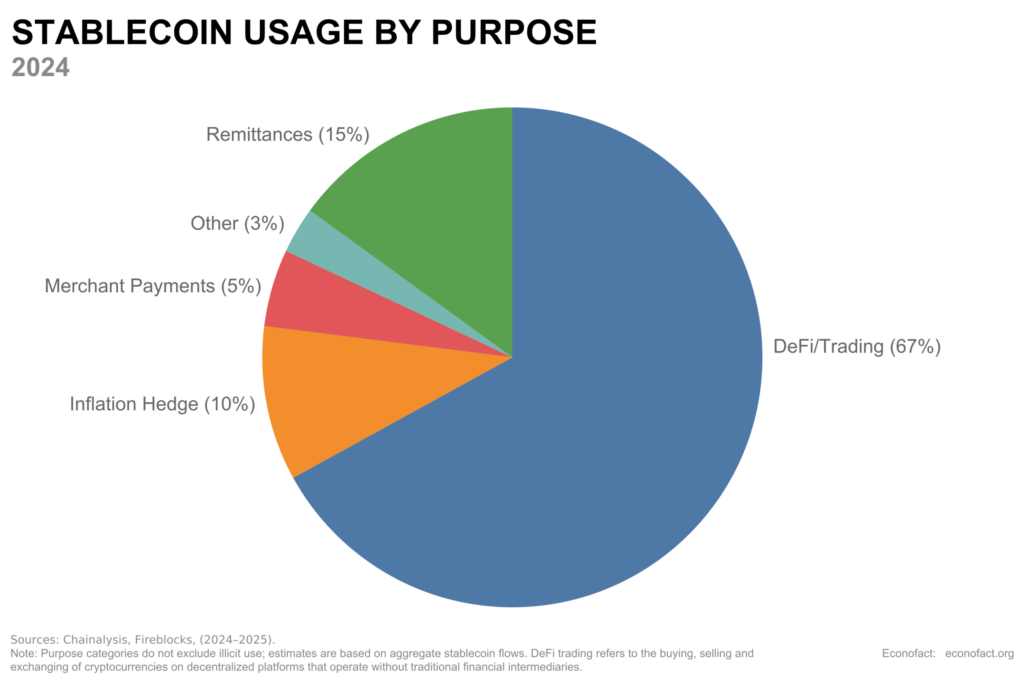

As of late 2023, the stablecoin market is valued at approximately $150 billion, showing remarkable growth from just a few billion dollars just a few years ago. Leading players include Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). These coins have become integral to trading on cryptocurrency exchanges and are often used for remittances and other financial activities.

JPMorgan’s Concerns

JPMorgan’s report highlights several key reasons why it believes achieving a trillion-dollar valuation in the stablecoin market by 2028 is unlikely:

- Regulatory Challenges: The regulatory landscape surrounding cryptocurrencies is evolving rapidly. Governments worldwide are increasingly scrutinizing stablecoins due to concerns about their potential impact on monetary policy and financial stability. Stricter regulations could hinder growth.

- Lack of Consumer Adoption: Despite growing interest in cryptocurrencies, mainstream adoption of stablecoins remains limited. Many consumers still prefer traditional banking systems over digital currencies for everyday transactions.

- Cyclical Market Sentiment: The cryptocurrency market is known for its volatility. Periods of bearish sentiment can lead to decreased demand for stablecoins as investors move away from crypto assets altogether during downturns.

- Competition from Central Bank Digital Currencies (CBDCs): CBDCs are gaining traction globally as governments explore digital versions of their currencies. These government-backed initiatives could provide more stability than privately issued stablecoins, potentially limiting their appeal.

The Role of Regulation

The regulatory environment plays a critical role in shaping the future of the cryptocurrency market, especially for stablecoins. In September 2023, U.S. regulators proposed new guidelines aimed at increasing transparency and accountability among issuers of stablecoins. While these measures could enhance consumer trust, they may also impose burdensome compliance requirements that smaller players may struggle to meet.

Consumer Behavior and Adoption Rates

The success of any financial instrument hinges significantly on consumer behavior. Currently, many individuals remain hesitant about using cryptocurrencies due to security concerns and volatility associated with non-stable assets. For instance, while some businesses accept Bitcoin or Ethereum as payment methods, few offer options for accepting stablecoins directly.

This hesitance is compounded by educational gaps regarding how these digital assets work; many consumers still lack an understanding of blockchain technology or how transactions occur within it.

The Impact of Market Sentiment

The sentiment surrounding cryptocurrencies tends to be cyclical—characterized by periods marked either by exuberance or fear among investors. When prices rise dramatically—like during the bull run seen in late 2020—interest in all forms of crypto surges; however when markets decline sharply—as observed throughout much of 2021—investors often retreat back into cash equivalents rather than holding onto their digital assets.

This phenomenon can lead directly back into reduced demand for even relatively more stable products like USDC or BUSD during downturns since users may prefer liquidity over speculative investments at those times.

CBDC Competition

A potential game-changer on this front could be central bank digital currencies (CBDCs). Countries such as China have already begun piloting CBDCs with plans from others—including Europe—to follow suit soon thereafter.

The introduction of CBDCs offers consumers an alternative that combines both stability backed by government reserves alongside technological advancements inherent within blockchain systems without exposing them entirely towards risks associated with decentralized finance platforms which many view skeptically today.

This might ultimately limit interest towards privately issued alternatives like Tether unless they can differentiate themselves effectively moving forward!